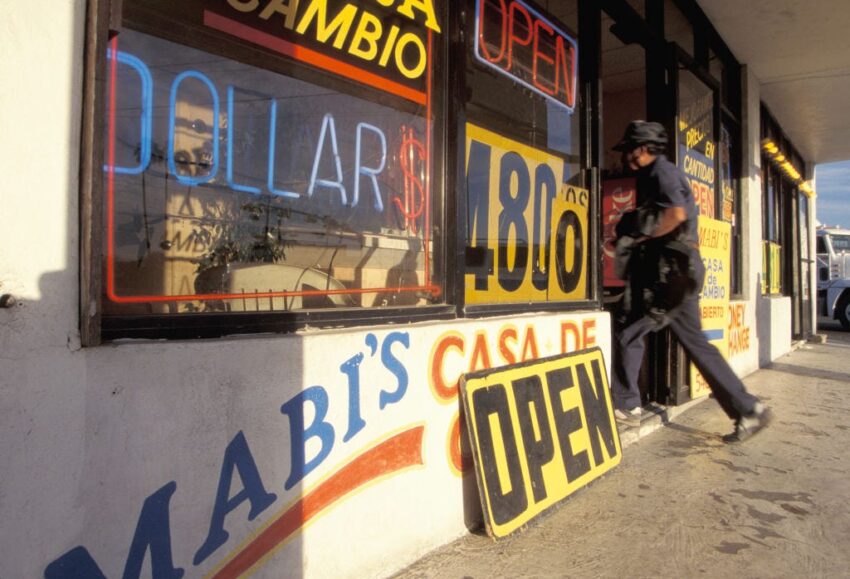

With so many changes being announced daily by the Trump administration, it can be difficult to keep up. One big change, however, has largely flown under the radar, even though it will have a huge impact on border communities: under a new Treasury Department policy, people in Texas and California who use money services like check-cashing stores, currency exchanges (casas de cambio), and money senders like Western Union will be required to fill out a form disclosing their personal information, including their Social Security number. This policy will apply to cash transactions at $200 or more and will not affect banks. This policy takes effect April 14 and will remain in place until September 9, 2025.

The policy was announced in a March 11 press release by the U.S. Department of Treasury’s Financial Crimes Enforcement Network, known as FinCEN, which issued a Geographic Targeting Order (GTO) across 30 zip codes in border communities in Texas and California.

In the press release, Secretary of the Treasury Scott Bessent cited investigating drug cartels as the reason for the new policy. “Today’s issuance of this GTO underscores our deep concern with the significant risk to the U.S. financial system of the cartels, drug traffickers, and other criminal actors along the Southwest border,” Bessent said.

The Border Chronicle sent FinCEN a request for additional information, such as whether details of the new policy will be distributed in Spanish. We also asked why FinCEN was targeting zip codes only in California and Texas. We received the following in writing from a FinCEN spokesperson: “At this time, we do not have any additional details to share beyond what’s included in the press release and Order that are posted at FinCEN.gov. FinCEN declines further comment.”

In this Q&A, Nicholas Anthony, a financial policy analyst with the Cato Institute, explains what this new policy means for border residents and businesses.

This new policy is going to cause a lot of confusion for border businesses, and really affect people who use money-transfer services to Mexico. Why is the Treasury doing this?

Let me just say thank you for covering this and raising awareness, because one of the biggest things that stresses me out is that there’s just a ton of people who live in these zip codes who are going to find out about this at the counter, and that’s not going to be a fun experience. As far as what the Treasury Department is trying to achieve, it’s really hard to say, because we have a lot of data that shows that this entire process is just not effective at stopping crime or identifying it.

A colleague predicted that when the Trump administration designated drug cartels as foreign terrorist organizations, we would soon see the types of tools that are used to fight terrorists, such as financial surveillance and financial controls, coming into action, and that’s where we are now with this order.

So it does look like it will really affect people who are sending remesas (remittances) to Mexico. Is that right?

Yes, it is going to affect people who are sending remittances. If they’re sending money from the United States to Mexico, they’re going to be caught up in this. It’s also going to catch people coming back from a vacation to Mexico who want to exchange unused pesos for dollars. They can get caught up in this. And even people who are just cashing a paycheck—they have been working all week, they want to cash a paycheck and go home, and they’re going to be caught up in this, so long as the amounts in these situations are over $200 or even just near $200, they’re effectively going to be put on a government watch list.

Can you give some examples of how this can play out? Say someone goes to Western Union to send money to family in Mexico. What happens under this new Treasury policy?

If they want to send someone in Mexico $100, it’s going to be business as usual. But if you’re sending $200 or more, the person behind the Western Union counter will fill out a currency transaction report. They’ll ask for the person’s name, what their business is, their Social Security number or employee identification number, what their address is. They’ll also ask for information about who’s going to receive the money, as well as where the money came from.

This is going to be a shock for people, especially if they’ve been sending money for years, and now they’re suddenly being asked to fill out a form to be sent to the government and provide a lot more information than they’re used to.

What happens if you don’t have a Social Security number?

In some cases, you may have folks who are undocumented, and they might use a Social Security number that does not belong to them. If they try to use that, then it’s very likely they’ll be flagged in the system. And if they don’t have one, then they might think that it’s the end of the conversation, and think, “Well, I can’t do this transaction. I need to go.”

But the problem then is that the financial institution will file what’s called a “suspicious activity report.” So this is a secondary report, which will report what happened to FinCEN and put them on alert that this person tried to evade the currency transaction report.

How does this affect small businesses in the borderlands, who do a lot of cross-border monetary transactions?

This is going to be tough on them, to say the least. Recently in an interview, the president of Reynosa Casa de Cambio, Xavier Guerra, said they file about 60 reports a month at the $10,000 threshold. At the new $200 threshold, he thinks that’s going to be more like 5,000 reports a month. So that’s nearly a 100-fold increase in what the business needs to be doing, and that’s a very dramatic change for a business to get effectively a 30-day heads-up that their compliance burden is going to increase 100-fold. Some businesses are going to have tough conversations about “Do we shut down?” Maybe they’ll even consider moving to some of the unaffected zip codes, just picking up the business and transferring locations. But that’s not something they can do overnight.

So is the burden on the business owner to file this paperwork, or the financial entity?

If you go to a money transmitter, like Western Union or a casa de cambio, it’s on them to file the paperwork. They’ll get the information from the customer, and they’re filling out all the paperwork, and ultimately responsible for its accuracy.

A woman from Maverick County, Texas, which is one of the targeted zip codes, told me the new policy will be especially hard for women, people who have side hustles, or people who are working informally.

If it’s someone’s side hustle and they made money, and they want to send it home as a remittance back to Mexico, then the sliver of good news is that the financial institution will walk them through all the information that’s needed to report it.

The bad news, though, is that they may not have all the information, especially when it comes to having a side hustle, if it’s a gig you do here and there. You may not have all the business requirements. For instance, if you’re just helping your neighbors out with yard work and making a little bit of extra cash, you probably don’t have that incorporated or set up as a business license, so things like that can become a big problem.

There can also be a situation where a husband or partner has control of the financial documents, and the wife doesn’t have access to those, and can’t take them with her to justify these transactions.

So this really disproportionately targets people who don’t have bank accounts?

The people who use these services the most tend to be people who don’t have a bank account. Unfortunately, just as a general note, the notice that FinCEN put out was not very detailed. They only noted that this was going to be required of money service businesses within the 30 affected zip codes, and they didn’t specify what they were looking for, or even provide a comprehensive list of who needs to comply.

I wrote a book about money laundering and drug cartels, and they have an army of accountants and lawyers who help them figure these things out. Even with the amount of flagrant money laundering that the Zetas cartel was doing at the time, it was still incredibly difficult for the IRS and the FBI to take that money-laundering ring down. It took years and many different federal agencies. Do you think this is going to have any impact on the drug cartels?

Maybe it has a small impact, but I have a very hard time imagining it’s going to have anywhere near the impact that would be necessary to justify this intrusion on people’s lives, both in terms of the cost to civil liberties and the cost to the businesses that now have to comply with this. I really do not see this changing the world by any means, but it does expand surveillance of border residents.

Read more: Read More

Read more: Read More